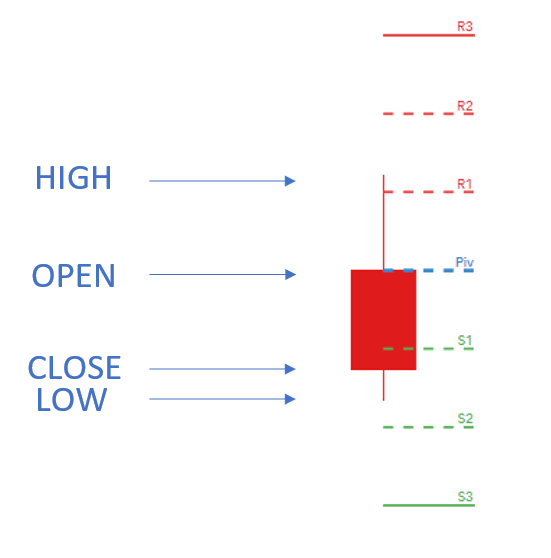

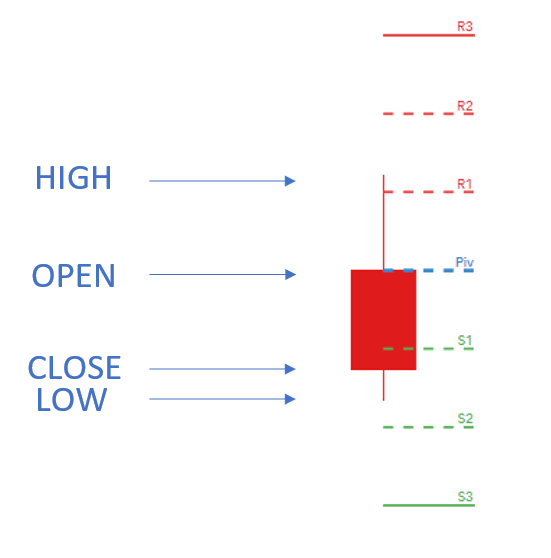

So based on the main pp level the floor trader pivots identify three support levels s1 s2 and s3 and three resistance levels r1 r2 and r3.

Floor trader pivots formula.

Central pivot high low close 3.

There are two main ways to trade pivot levels harrison 2011.

Depending on the type of pivot formula used you can generally generate and use up to 9 levels.

They plug in the high low and close from the previous day and then the formula gives them seven levels to watch.

The high low and close used in the calculation is from the prior day s values.

A calculated pivot often called a floor trader pivot is derived from a formula using the previous day s high low and closing price the result is a focal price level about.

Trade with floor trader pivots support and resistance.

Types of pivots.

Pivot system support and resistance explained.

The name floor trader pivots comes from a time before online trading where floor trader s needed an easy formula to determine whether a price was relatively cheap or expensive before.

The formula uses the previous day s high low and close to calculate the central pivot neutral area for the market.

They determine specific pivot points or central pivots that define a sort of equilibrium point or a neutral market.

A pivot point is a technical analysis indicator used to determine the overall trend of the market over different time frames.

Pivot points are also know as floor trader pivots or pivots or floor pivots or session pivots.

Calculate floor trader pivots.

But how can we use these levels in our trading.

The pivots can be.

Below are the calculations for the floor trader pivots that are sometimes used in the broadcast and are listed daily in the shadowtrader pro swing trader.

Floor traders and other professionals who do the actual buying and selling of futures contracts in the trading pits of the exchanges generally employ very similar systems for valuing the price of these instruments in.

Generally these values are derived from the e mini s p futures also known as es.

These are the places where traders expect support and resistance to occur in the market and as such are used as entry and exit points for trades.

The floor pivot points are the most basic and popular type of pivots.

Each day floor traders use a formula to calculate what might be the pivot points for the day s trading.

Floor trader pivots are often called calculated pivots because they are determined through a series of calculations using numbers from previous days.

With so many large traders keying off of these levels they can become a self fulfilling prophecy.

Floor trader pivot calculator calculate pivot levels for any trading instrument.